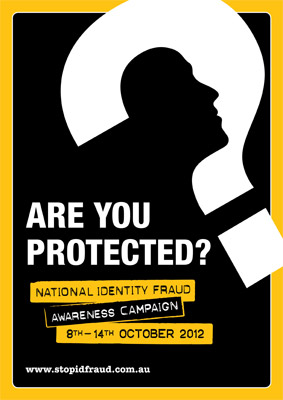

National Identity Fraud Awareness Week 2012

National Identity Fraud Awareness Week 2012

Security experts are urging Australians to take better care of their most important asset, their identity, in the lead up to National Identity Fraud Awareness Week.

Australians lost an alarming $1.4 billion dollars in a 12-month period due to personal fraud according to the Australian Bureau of Statistics Personal Fraud Survey 2010-11.

Taking place from 8 to 14 October, National Identity Fraud Awareness Week (NIDFAW) is aiming to educate consumers and businesses on how to protect their personal or business identity from the world's fastest growing crime.

NIDFAW spokesperson and Fellowes® Australia Marketing Manager, Peter Campbell, said while identity fraud is a significant issue, many Australians are unaware of the risk of identity crime.

'A lot of people don't understand the dangers associated with identity crime and just how easy it can be to have your identity stolen," Mr Campbell said.

'In today's environment, consumers are being asked to disclose more and more personal information than ever before leading to greater risk of identity fraud.

'Information such as your date of birth, mother's maiden name and passwords are as valuable as money.

'These details provide enough information for a fraudster to open bank accounts, apply for credit cards, loans and much more."

According to a 2012 study by leading data intelligence and insights company, Veda, more than 3.8 million adult Australians have experienced at least one form of identity crime, such as identity fraud or illegal access to their personal or financial data.

The study also found that a total of 1.5 million Australians have reported illegal access of their bank accounts by a fraudster.

'It's not only individuals who are affected by identity fraud, businesses are at risk too," Mr Campbell said.

'Once you lose your identity it can be a costly and time consuming exercise trying to get it back.

'For businesses, trying to get your business identity back can paralyse your business operation and put your entire business at risk."

Consumers and businesses are being urged to take a more proactive approach to tackling this problem by employing available document security measures, like locking their letterbox and shredding sensitive documents before disposing of them.

'Through activities like National Identity Fraud Awareness Week, we are trying to get the message out there that people need to think twice about how they are disposing of printed materials in particular and take practical steps to reduce their chances of becoming a victim of personal fraud," Mr Campbell said.

'Consumers should also look into installing security software on their home computer in order to eliminate the risk of online identity theft."

NIDFAW is now in its sixth year and is an ongoing initiative of leading security products company, Fellowes®, with support in 2012 from campaign partners including Crime Stoppers, Norton by Symantec and Veda.

National Identity Fraud Awareness Weekis Australia and New Zealand's only nationwide awareness campaign designed to help you protect yourself or your business from identity fraud – the world's fastest growing crime. Now in its sixth year, National Identity Fraud Awareness Week is an initiative of leading security products company, Fellowes®, aiming to educate Australians and New Zealanders about the dangers of identity fraud.

The Facts

Australians lost $1.4 billion dollars in a 12-month period due to personal fraud according to the Australian Bureau of Statistics Personal Fraud Survey 2010-11.

Personal fraud affects 1.2 million Australians, or 6.7% of the population.

Private information such as your date of birth, mother's maiden name and passwords are as valuable as money. This is enough information for a fraudster to open bank accounts, apply for credit cards, loans and much more.

Businesses that suffer corporate identity fraud may be in breach of client confidentiality, which opens them to legal action for noncompliance with the Privacy Act.

NIDFAW Tips to Protect your Identity

1. Protect your important and personal information by ensuring it is stored safely.

2. Reduce the risk of identity theft by investing in a Fellowes® shredder and shredding unwanted documents that contain sensitive information.

3. Check your account statements regularly and look for any unusual or unauthorised activity.

4. Subscribe to an ID theft protection/monitoring service such as Secure Identity that allows you to proactively monitor your credit file for fraudulent activity and be able to react swiftly should you become a target for ID theft.

5. Contact your credit card company and banking institution before departing for travel, or your travel may prompt a block on your account.

6. Create passwords/PINS that are not easily associated with you, such as your date of birth, phone number or age.

7. Use Internet banking sites with caution, be wary of and never provide banking details through unsolicited emails or phone calls.

8. Discuss the risks of identity fraud with your family, friends and colleagues and raise awareness of this growing issue

Visit www.stopidfraud.com.au for more information on protecting yourself or your business from ID fraud. You can also rate your risk of identity fraud on the NIDFAW website by taking the online quiz.

MORE