Jo Kelly Likes Before Long Term Goals Interview

Is Social Media Driving Your Shopping Addiction?

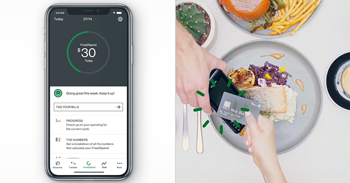

New research from Australia's leading digital bank, UBank, reveals the impact social media could be having on wallets, with two thirds (66 per cent) of millennials admitting what they see on their newsfeeds drives impulse spending.

The research found there's a new 'economy' emerging within social media – driving spending, but also sparking financial conversations across networks. In fact, 47 per cent of digital-native millennials are using social media as a channel to share their financial position or spending habits.

This new social economy is also driving a desire to build an online image others aspire to match. Not only does sharing purchases online make millennials feel 'really happy' (47 per cent), it also lets them show off their purchases with 27 per cent hoping to impress followers.

Millennials are also hyper-aware of how the friends and followers in their networks spend money, with 68 per cent looking to friends, family, influencers and brands for future purchase ideas.

But this awareness and constant connection to friends and influencers can cause jealousy, with a quarter of millennials (25 per cent) admitting they feel envious when they see what others have purchased. And, this envy is triggering action with 23 per cent saying they have purchased over-budget items purely to get a response on social media. In fact, more than a quarter (26 per cent) say they're compromising their financial future by what they share on social media, while one in ten millennials would prefer 1000 likes on a social media post over $200 in a savings/super account.

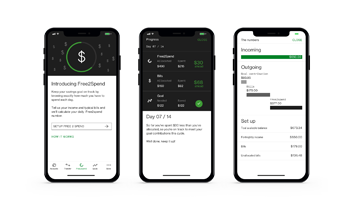

Given this growing pressure to spend freely in real-time while also maintaining savings goals, UBank has created Free2Spend, a revolutionary in-app tool that simplifies all aspects of personal finance into one number. As a future-focused tool, Free2Spend helps customers make informed spending decisions quickly and easily, rather than focusing on the past.

UBank CEO Lee Hatton said, "For many people, managing personal finances has become too complicated and it doesn't need to be. Balancing savings goals and day-to-day expenses with 'instant gratification' spending can be challenging. That's why we've launched Free2Spend.

"It allows you to balance your income with your savings goals and fixed expenses. Using this information, the tool then calculates your daily Free2Spend number or 'one number' to spend on whatever you want. It's a solution that can keep up with our customers and their busy lives.

"Since launching, we've seen our customers check Free2Spend as regularly as they would check their social networks – at least ten times a day – so it's having a strong impact. It's the social media solution to your finances."

For more information or to sign up go to https://www.ubank.com.au/free2spend.

Free2Spend is available on iOS (10+) and can be downloaded from the App Store3 via the UBank app.

Interview with Jo Kelly, UBank CMO

Interview with Jo Kelly, UBank CMO

Question: What did the UBank Millennial research find?

Jo Kelly: To better understand the impact social media is having our wallets, UBank commissioned research to look at the spending and saving habits of millennials. The results were clear: two thirds of millennials said social media envy was driving impulse spending.

Question: Are you surprised that nearly one-quarter of millennials are making out-of-budget purchases to get a response on social media?

Jo Kelly: It's actually something many of us can relate to on some level – is there a new dress with the tags still attached hanging in your wardrobe? Or a gadget you had to have, which is now collecting dust in the back of the cupboard? Instant gratification isn't a new phenomenon, but seeing new shiny purchases every day in our social feeds is making us hyper-aware of how others are spending their money, fuelling the desire to spend and impress. At the end of the day, we're not here to tell people what they should or shouldn't spend their money on. Rather, we're here to help our customers achieve their goals, whatever they may be, and help them manage their spending and saving in a way that works for them.

Question: How does this spending correlate with who we follow on social media and specific advertising?

Jo Kelly: According to our findings, millennials are always looking to their network for purchase inspiration. It's not only brands and influencers that impact their spending, but also friends and family.

Question: Why are we obsessed with getting likes on our social media?

Jo Kelly: The research suggests millennials are obsessed with 'likes' in order to build an image of themselves that others envy. In fact, our research found 27 per cent post on social media with the intention of impressing others. This new social media economy has arisen as a new means for us to communicate, revolutionising the way we interact with others.

Question: What advice do you have for millennials who would prefer 1,000 likes on a social media post over $200 in a savings/super account?

Jo Kelly: It's all about balance. Millennials sometimes get a bad reputation when it comes to saving money, but using the right tools can make it much easier. That's why we introduced Free2Spend – it helps you reach your goals without putting a handbrake on the lifestyle you want to have.

Question: What is Free2Spend?

Jo Kelly: Free2Spend is a revolutionary tool that simplifies all aspects of money – savings goals, income, expenses and spending – into one number. Free2Spend helps users put their budgeting on auto-pilot by providing a daily spend limit that adapts and changes in real time. But what really sets Free2Spend apart is that it looks forward into the future instead of focusing on what you've spent in the past. Think about a mapping application like Google Maps or Waze – you enter your destination, it tells you how to get there and updates along the way if you take a wrong turn or decide to take a different route.

Question: How does Free2Spend work?

Jo Kelly: Free2Spend first asks users to set a savings goal; whether they're saving for a wedding, an investment property, or a holiday, or even just saving in general. Then, users input their income and fixed expenses which the tool uses to calculate a daily Free2Spend allowance or 'one number'. For example, if you're saving for a $20,000 car, and you have a monthly income of $5,000 with monthly expenses like rent, utilities and bills of $2,500, Free2Spend will take these into consideration to provide a daily spend limit for the month to be spent however you please.

Question: How will Free2Spend stop millennials making purchases they can't afford?

Question: How will Free2Spend stop millennials making purchases they can't afford? Jo Kelly: Free2Spend is essentially the social media solution for your finances because it's quick and easy with one number to focus on each day. Not only does Free2Spend take into account savings goals first, it updates in real time so you're free to buy that new dress, check the app and see how you're tracking with your daily spend allowance. If you overspend, your Free2Spend number will reduce to help get you back on track, if you underspend, you'll have more to put towards your savings. Since launching Free2Spend, we've seen our customers check the tool as regularly as they would check their social networks and are ten times more connected with their finances as a result.

Question: Could you share other budget and saving tips, with us?

Jo Kelly: One great one to adapt is to make financial decisions when you're in a positive headspace. Spending money can be an emotional experience and many people spend money to try and make themselves happier. This can cause excessive spending and create debt. If you've had a tough day at work or you're feeling stressed, limit spending until you're back in a positive headspace. Impulse purchases will only provide short term relief and the weight of the debt will come back to haunt you when bills need to be paid.

Interview by Brooke Hunter

MORE